News Tag: English

-

BeammWave presents at Stora Aktiedagarna

BeammWave’s CEO Stefan Svedberg will provide an update on the company’s current activities, ongoing collaborations and the company’s progress. Date & Time: June 10, 2025, at 17.15 Location: Stora Aktiedagarna, Stockholm, get details and sign up for the event here. If unable to attend in person, the presentation will be streamed online at the following…

-

BeammWave to participate in Wireless Japan 2025 – Showcasing cutting-edge beamforming innovation

BeammWave will participate in Wireless Japan 2025, one of Japan’s leading wireless and communication technology exhibitions. The event will take place at Tokyo Big Sight from May 28 to 30, 2025. BeammWave is proud to be part of the XGMF stand, presenting its breakthrough digital beamforming technology for mmWave 5G and 6G solutions. BeammWave will…

-

BeammWave Appoints Svein-Egil Nielsen as New Chairman of the Board

Svein-Egil Nielsen has been appointed Chairman of the Board of BeammWave AB following the company’s Annual General Meeting on May 14, 2025. BeammWave AB today announces that Svein-Egil Nielsen has been appointed Chairman of the Board, following a decision made at the Annual General Meeting earlier this week. Nielsen, former CTO and EVP R&D of…

-

Bulletin from the Annual General Meeting 2025 in BeammWave AB (publ)

The annual general meeting in BeammWave AB (publ) (the "Company") was held on May 14, 2025. At the general meeting, the following main resolutions were passed. Adoption of the income statement and the balance sheetThe general meeting resolved to adopt the income statement and the balance sheet for the financial year 2024, as presented in…

-

BeammWave Interviewed by Redeye – Continued transition towards high volume products

Stefan Svedberg, CEO at BeammWave, interviewed by Rasmus Jacobsson – Equity Analyst, Redeye, to reflect on the key milestones during the first quarter of 2025. BeammWave has released its next generation ADP1 platform. Driven by customer readiness for project advancement and aligned with BeammWave's internal roadmap, the release gives a tantalising indication of customer progress.…

-

BeammWave publishes Interim Report for January-March 2025

BeammWave enters industrialization phase with strong customer momentum. BeammWave AB's Interim Report for January-March 2025 is now available on the Company's website beammwave.com/investors/financial-reports/. Our customers are progressing well and are prepared to move into the next phase. We are supporting this with the new version of ADP1 and by sampling chips for customer prototyping.We are…

-

BeammWave launches Next Generation of its Advanced Development Platform (ADP1)

With the first generation well received, BeammWave is now launching the next generation of its Advanced Development Platform (ADP1). Since its launch in late 2023, ADP1 has proven to be an extremely powerful tool for both customers as well as for BeammWave’s internal roadmap. The new release enables both existing and new customers to explore…

-

Notice of Annual General Meeting in BeammWave AB (publ)

The shareholders of BeammWave AB (publ), reg.no. 559093-1902 (the "Company"), are hereby invited to attend the annual general meeting on 14 May 2025, at 12.00 at the Company's premises, Forskningsbyn Ideon, Scheelevägen 15M, 223 63 Lund. Right to participate and notificationShareholders wishing to attend the annual general meeting shall: be entered in the share register…

-

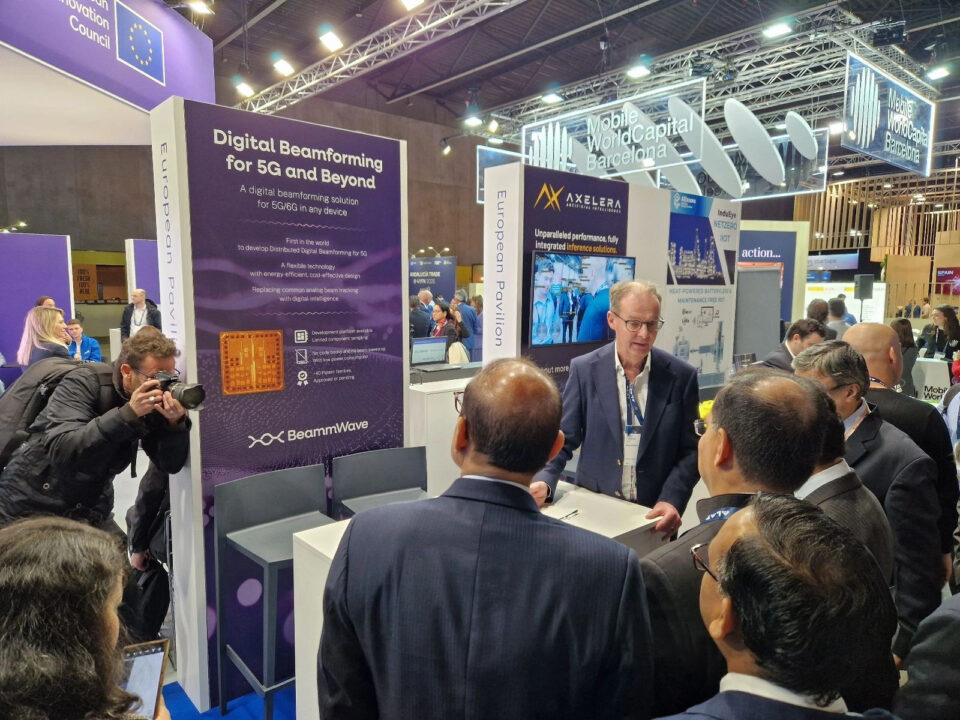

BeammWave’s Successful Debut at MWC – A Breakthrough Week in Barcelona

Exhilarating, exhausting, and truly groundbreaking – that’s how we sum up our first time exhibiting at MWC Barcelona. This is the event where the mobile industry converges, where game-changing ideas take flight, and where the biggest players dominate the show floor with booths the size of small cities. For BeammWave, this was our first time…

-

BeammWave to participate and exhibit at Mobile World Congress – MWC 25

As the world's largest and most influential connectivity event, this premier international trade fair brings together industry leaders to exchange insights and explore business opportunities. We have been selected to participate in the European Pavilion at MWC 2025, taking place from March 3-6 in Barcelona, Spain. “Following a highly competitive selection process, we are honored…

-

BeammWave Interviewed by Redeye – A Year of Technical Breakthroughs, New Contracts, and Increasing Momentum

Stefan Svedberg, CEO at BeammWave, interviewed by Rasmus Jacobsson – Equity Analyst, Redeye, to reflect on the key milestones of 2024 and the beginning of 2025. “We have had the best quarter ever with two new big customers, and a defence project with Saab, followed in January by a successful installation of our development platform…

-

A Year with Technical Breakthroughs, New Contracts and an Increasing Momentum

BeammWave AB's Year end-report for 2024 is now available on the Company's website beammwave.com/investors/financial-reports/. Being the first in the world to successfully demonstrate Distributed Digital Beamforming during the summer was a key breakthrough. This achievement was followed in Q4 by the addition of two new contracts and a joint project with Saab. Highlights during the…