Right to participate and notification

Shareholders wishing to attend the annual general meeting shall:

- be entered in the share register prepared by Euroclear Sweden AB on 6 May 2025; and

- notify the Company of their participation no later than 8 May 2025.

Notification of participation should be made by e-mail to agm@beammwave.com. Notification may also be made in writing to BeammWave AB, Forskningsbyn Ideon, SE-223 70, Lund, Sweden. In the notification, the shareholder should state full name, personal identity number or corporate identity number, shareholding, address, daytime telephone number, e-mail address and, where applicable, information about representatives, proxies or advisors (maximum 2).

Proxy and power of attorney

If a shareholder is to be represented by proxy, the proxy must bring a written, dated and by the shareholder signed power of attorney in original to the meeting. The power of attorney may not be older than one year, unless a longer period of validity (but no longer than five years) has been specified in the power of attorney. If the power of attorney is issued by a legal entity, the proxy must also bring a current registration certificate or equivalent authorization document for the legal entity. The Company provides the shareholders with a power of attorney for this purpose on the Company's website, www.beammwave.com. The power of attorney can also be ordered by e-mail as described above. To facilitate entry, a copy of the power of attorney and other authorization documents should be attached to the notification to the general meeting.

Nominee registered shares

In order to be entitled to participate in the general meeting, a shareholder with shares registered in the name of a nominee, through a bank or other nominee, must, in addition to registering for the meeting, have the shares registered in their own name with Euroclear Sweden AB so that the shareholder is entered in the share register as of 6 May 2025. Such temporary registration (so-called voting rights registration) should be requested from the nominee in accordance with the nominee's routines in such time in advance as the nominee determines. Voting rights registrations made no later than 8 May 2025 will be taken into account in the preparation of the share register.

Proposal for the agenda

- Opening of the meeting

- Election of the chairman of the meeting

- Preparation and approval of voting list

- Approval of the agenda

- Election of one or two persons to verify the minutes

- Examination of whether the meeting has been duly convened

- Presentation of the annual report and the auditor’s report

- Resolution in respect of

- adoption of the income statement and balance sheet

- the allocation of the Company's profit or loss according to the adopted balance sheet, and

- discharge from liability for the board members and the managing director

- Determination of fees to the board members and the auditors

- Determination of the number of board members and any deputy board members, and the number of auditors and any deputy auditors

- Election of board members and any deputy board members and auditors and any deputy auditors

- Resolution on the nomination committee for the next annual general meeting

- Resolution on authorization for the board of directors to decide on a new share issue

- Resolution on the introduction of incentive programs

- Closing of the meeting

Proposals for decisions

Item 8.b. Resolution in respect of the allocation of the allocation of the Company's profit or loss according to the adopted balance sheet

The board of directors proposes that the accumulated loss of the Company be carried forward and that no dividend be paid for the financial year 2024.

Item 9. Determination of fees to the board members and the auditors

The nomination committee proposes that the annual general meeting resolves that fees to the board members elected by the general meeting shall be paid in the amount of two (2) price base amounts to the chairman of the board and in the amount of one (1) price base amount to each of the other ordinary board members, and that fees to the auditor shall be paid in accordance with approved invoices in accordance with standard charging principles.

Item 10. Determination of the number of board members and any deputy board members, and the number of auditors and any deputy auditors

The nomination committee proposes that the board of directors shall consist of seven (7) board members without deputies and that the Company shall have one (1) authorized public accounting firm as auditor.

Item 11. Election of board members and any deputy members, and auditors and any deputy auditors.

The nomination committee proposes that the annual general meeting resolves to re-elect the board members Fredrik Rosenqvist, Märta Lewander Xu, Markus Törmänen, Gustav Brismark, Paula Eninge, Svein-Egil Nielsen and Per Wijk for the period until the end of the next annual general meeting. Information about the board members is available on the Company's website; www.beammwave.com.

The nomination committee proposes that Svein-Egil Nielsen is elected as chairman of the board.

It is proposed that the auditing firm Deloitte AB be re-elected as auditor for the period until the end of the next annual general meeting. Deloitte AB has announced that the authorized public accountant Maria Ekelund will continue as auditor in charge.

Item 12. Resolution on the nomination committee for the next annual general meeting

The nomination committee proposes that the annual general meeting resolves on unchanged guidelines for the work of the nomination committee and the forms for the appointment of the nomination committee, meaning that the following guidelines are proposed to continue to apply:

The task of the nomination committee shall be to make proposals to the next annual general meeting on the following issues:

- election of the chairman of the general meeting;

- determination of the number of board members and the number of auditors

- determination of fees to the board of directors and the auditor

- the election of the board of directors and the auditor, and

- decision on principles for the appointment of the Nomination Committee

The nomination committee shall have four members. The three in terms of voting rights largest shareholders/owner groups (including both directly registered and nominee-registered shareholders) (the "Largest Shareholders") in the Company as of 30 September of the year preceding the year in which the annual general meeting is held, according to the ownership information in the share register maintained by Euroclear Sweden AB or who otherwise at that time proves to be among the Largest Shareholders, may each appoint one member. In addition, the chairman of the board shall be appointed to the nomination committee. The chairman of the board shall, no later than 15 October of the year preceding the year in which the annual general meeting is held, contact the Largest Shareholders of the Company and offer them to each appoint one member to the nomination committee. If any of these waive their right to appoint a member, the next shareholder/owner group in order of size shall be given the opportunity to appoint a member to the nomination committee, and so on until the nomination committee consists of four members.

The managing director shall not be a member of the nomination committee. The chairman of the board of directors shall convene the first meeting of the Nomination Committee. At least one of the members of the Nomination Committee shall be independent in relation to the largest shareholder or group of shareholders in the Company in terms of voting rights. If more than one board member is part of the Nomination Committee, no more than one of them may be dependent in relation to the Company's major shareholders.

If it becomes known that any of the shareholders who appointed a member of the nomination committee as a result of changes in the owner's shareholding or as a result of changes in the shareholding of other owners, at a time more than two months before the annual general meeting, no longer belongs to the Largest Shareholders, the member appointed by the shareholder shall, if the nomination committee so decides, resign and be replaced by a new member appointed by the shareholder who at the time is the largest registered shareholder who has not already appointed a member of the nomination committee.

If the registered ownership structure otherwise changes significantly before the nomination committee's assignment is finalized, the composition of the nomination committee shall, if the nomination committee so decides, be changed in accordance with the principles set out above.

Information on the names of the members of the nomination committee shall be provided on the Company's website no later than six months before the annual general meeting. If a member has been appointed by a specific shareholder, the name of the shareholder shall also be stated. If a member leaves the nomination committee, this shall be stated, and if a new member is appointed, corresponding information about that member shall be provided.

Item 13. Resolution on authorization for the board of directors to decide on a new share issue

The board of directors proposes that the meeting authorizes the board of directors to, on one or more occasions, during the period until the next annual general meeting, resolve to increase the Company's share capital. The increase of the share capital may be made through a new issue of class B shares, convertible bonds and/or warrants entitling to conversion or subscription of new shares. The board of directors may decide on such issue with deviation from the shareholders' preferential rights and/or with provision for cash payment or payment in kind, set-off or otherwise with conditions as referred to in Chapter 13, Section 5, paragraph 6 of the Swedish Companies Act (2005:551).

Issuance in accordance with this authorization shall be made at market subscription price, subject to market issue discount where applicable. Otherwise, the board of directors shall be able to decide on the terms and conditions of the issue in accordance with this authorization and who shall be entitled to subscribe for new shares, convertible bonds and/or warrants. The board of directors or the person appointed by the board of directors is authorized to make the minor adjustments required for the registration of the resolution with the Swedish Companies Registration Office and Euroclear Sweden AB.

The purpose of the authorization and the reasons for any deviation from the shareholders' preferential rights or otherwise with conditions as set out above are that issues may be made for the purpose of carrying out or financing acquisitions of all or parts of other companies or businesses and to finance existing operations. The board of directors shall be authorized to decide on the detailed terms of the issue.

Item 14. Resolution on the introduction of incentive programs

The board of directors proposes that the general meeting resolves on the introduction of incentive programs in the form of:

- Qualified employee stock options, including decisions on

- directed issue of warrants to secure delivery of shares, and

- authorization of onward transfer ("KPO Employees Series 2025");

- Stock options for employees and key persons, including decisions on

- directed issue of warrants, and

- approval of onward transfer ("TO Employees Series 2025").

A. KPO Employees Series 2025

The board of directors proposes that the general meeting resolves to implement an incentive program for employees in the Company by issuing so-called qualified employee stock options pursuant to Chapter 11 a of the Swedish Income Tax Act (1999:1229) (the "Income Tax Act") with a right to acquire new shares in the Company in accordance with the following. The proposal also includes a resolution to issue warrants to secure delivery of the shares pursuant to the incentive program (if and to the extent the Company wishes to deliver shares through the use of such warrants) and approval of the transfer of such warrants and/or shares as follows.

A.1 Guidelines for KPO Employees Series 2025

The board of directors proposes that the general meeting resolves on the introduction of the incentive program KPO Employees Series 2025 according to the guidelines below:

- The program shall comprise a maximum of 472,120 qualified employee stock options to be allotted to participants free of charge.

- Each qualified employee stock options entitles the holder to acquire one (1) new B-share in the Company at an exercise price corresponding to the quotient value per share.

- The exercise price and the number of new shares each qualified employee stock option entitles to the acquisition of may be subject to recalculation, in which case the recalculation terms in the complete terms and conditions for the employee stock options (see below) shall apply accordingly.

- The incentive program shall include employees of the Company who are eligible to participate in qualified employee stock option programs under the Income Tax Act. The board of directors is authorized to decide which employees are offered employee stock options, category and number according to the following guidelines:

- Only employees of the Company who are eligible under the Income Tax Act may be offered qualified employee stock options;

- Employees of the Company who have already received employee stock options through participation in the Company’s previous incentive programs are not eligible to participate in the program;

- The program includes the following categories of participants and participants within a category shall initially be offered equal shares within the number of the category. Employee stock options that remain may be allocated to other participants, including between categories;

| Categories |

Number of participants |

Total number |

| Category A – Juniors |

5 |

84,250 |

| Category B – Seniors |

4 |

135,120 |

| Category C – Experts |

5 |

252,750 |

|

Total: 14 |

Number: 472,120 |

- A participant may never be granted more employee stock options than the limit of value as follows from the Income Tax Act.

- Allocation of employee stock options by concluding agreements on employee stock option with the participants shall take place no later than 31 December 2025.

- The granted employee stock options vest over a minimum period of 36 months and may only be exercised for the acquisition of new shares if the employee is still employed and the other conditions for qualified employee stock options under the Income Tax Act are met.

- The stock options do not constitute securities and may not be transferred or pledged and may only be exercised for the acquisition of new shares in the Company by the person to whom they are granted.

- The holder shall be able to exercise vested employee stock options for approximately one month after the vesting period.

- The employee stock options shall be subject to the detailed terms and conditions as fully proposed by the board of directors and shall be governed by specific employee stock option agreements with the respective participants. The board of directors shall be responsible for the design and management of the KPO Employees Series 2025 within the framework of the above guidelines.

A.2 Directed issue of warrants under KPO Employees Series 2025

The board of directors proposes that the general meeting resolves on a directed issue of not more than 472,120 warrants, entailing an increase of the share capital upon full exercise of not more than SEK 46,662.28 (subject to any recalculations in accordance with the customary terms and conditions of the warrants that shall apply to the warrants). The resolution shall otherwise be subject to the following conditions.

- The right to subscribe for the warrants shall, with deviation from the shareholders' preferential rights, belong to BeammWave AB (publ) with the right and obligation to transfer the warrants to employees of the Company who participate in the incentive program KPO Employees Series 2025. Oversubscription cannot take place.

- The reasons for the deviation from the shareholders' preferential rights are to enable delivery of new shares to the employees participating in the incentive program KPO Employees Series 2025, whereby employees shall be able to become long-term shareholders and take part in and work for a positive value development of the share in the Company during the period covered by the proposed program, and that the Company shall be able to retain and attract the necessary competence in the Company.

- The warrants are issued free of charge.

- Subscription of the warrants shall be made on a separate subscription list no later than 27 June 2025. The board of directors has the right to extend the subscription period.

- Subscription of shares by virtue of the warrants can take place during the period from 1 July 2028 up to and including 31 December 2028.

- Each warrant entitles the holder to subscribe for one (1) new class B share in the Company at a subscription price per share corresponding to the quotient value per share.

- The warrants shall also be subject to the other conditions set out in the complete proposal of the board of directors.

- The board of directors or the person appointed by the board of directors is authorized to make the minor adjustments necessary for the registration of the resolution with the Swedish Companies Registration Office.

A.3 Authorization of retransfer

The board of directors further proposes that the general meeting resolves to approve the transfer of warrants and/or shares created through the exercise of employee stock options for the delivery of new shares to participants in KPO Employees Series 2025.

Warrants under KPO Employees Series 2025 held by the Company and not transferred to participants as a result of participants not exercising employee stock options shall be canceled by the Company following a decision by the board of directors of the Company and notified to the Swedish Companies Registration Office.

B. TO Employees Series 2025

The board of directors proposes that the general meeting resolves to implement an incentive program in the form of warrants for persons engaged in the business as employees or on a consultancy basis who (for various reasons) are not qualified to participate in KPO Employees Series 2025 as follows. The proposal also includes a resolution to issue warrants for onward transfer to participants in TO Employees Series 2025 and approval of transfer of such warrants as follows.

B.1 Guidelines for TO Employees Series 2025

The board of directors proposes that the general meeting resolves to implement the incentive program TO Employees Series 2025 in accordance with the guidelines below:

- The program shall comprise a maximum of 126,495 warrants to be offered to the participants at a market valuation based on the Black & Scholes valuation model.

- Each warrant entitles the holder to acquire one (1) new class B share in the Company at an exercise price corresponding to 175 percent of the volume-weighted average price calculated as an average of the daily volume-weighted price paid for the Company's share on Nasdaq First North Stockholm's official price list during ten (10) trading days immediately preceding the general meeting, however, not less than the quotient value per share.

- The exercise price and the number of new shares each warrant entitles to may be subject to recalculation, in which case the recalculation terms in the complete terms and conditions for the warrant (see below) shall apply accordingly.

- The board of directors is authorized to decide the persons to whom warrants are offered and the number of warrants according to the following guidelines:

- Only employees and consultants who are active in the Company may be offered warrants TO Employees Series 2025 and who are not eligible to participate in KPO Employees Series 2025.

- Employees and consultants who are active in the Company who have already received warrants through participation in the Company’s previous incentive programs are not eligible to participate in the program;

- The program includes the following categories of participants and participants within a category shall initially be offered equal shares within the number of the category. Warrants that remain may be offered to other participants, including between categories:

| Categories |

Number of participants |

Total number |

| Category B – Seniors |

1 |

50,670 |

| Category C – Experts |

1 |

75,825 |

|

Total: 2 |

Number: 126,495 |

- Allocation of warrants by way of transfer of warrants to the participants shall be made no later than 27 June 2025.

- The holder may exercise the allocated warrants during the period from 1 July 2028 until 31 July 2028.

- The warrants shall be subject to the detailed terms and conditions set out in the board of directors' complete proposal, and may be supplemented with customary agreements regarding vesting period and pre-emption rights with each participant. The board of directors shall be responsible for the design and management of the incentive program TO Employees Series 2025 within the framework of the above guidelines.

B.2 Directed issue of warrants TO Employees Series 2025

The board of directors proposes that the general meeting resolves on a directed issue of not more than 126,495 warrants, entailing an increase of the share capital upon full exercise of not more than SEK 12,502.22 (subject to any recalculations in accordance with the customary terms and conditions of the warrants that shall apply to the warrants). The resolution shall otherwise be subject to the following conditions.

- The right to subscribe for the warrants shall, with deviation from the shareholders' preferential rights, belong to BeammWave AB (publ) with the right and obligation to transfer the warrants to employees and consultants active in the Company. Oversubscription is not possible.

- The reasons for the deviation from the shareholders' preferential rights are to introduce an incentive program whereby employees and consultants working in the Company shall be able to become long-term shareholders and take part in and work for a positive value development of the share in the Company during the period covered by the proposed program, and that the Company shall be able to retain and attract the necessary competence in the Company.

- The warrants are issued free of charge.

- Subscription of the warrants shall be made on a separate subscription list no later than 27 June 2025. The board of directors has the right to extend the subscription period.

- Subscription of shares by virtue of the warrants can take place during the period from 1 July 2028 up to and including 30 July 2028.

- Each warrant entitles the holder to subscribe for one (1) new class B share in the Company at a subscription price per share corresponding to 175 percent of the volume-weighted average price calculated as an average of the daily volume-weighted price paid for the Company's share on Nasdaq First North Stockholm's official price list during ten (10) trading days immediately preceding the annual general meeting, however, at least corresponding to the quotient value per share.

- The warrants shall also be subject to the other conditions set out in the complete proposal of the board of directors.

- The board of directors or the person appointed by the board of directors is authorized to make the minor adjustments necessary for the registration of the resolution with the Swedish Companies Registration Office.

B.3 Approval of transfer

The board of directors further proposes that the general meeting resolves to approve the transfer of warrants to participants in the incentive program TO Employees Series 2025 in accordance with the guidelines set out in section B.1 above and on the following conditions.

- Warrants of TO Employees Series 2025 shall be transferred at a market value (premium) based on an estimated market value of the warrants, which shall be calculated by an independent valuation company using the Black & Scholes valuation model.

- The value of the warrants of TO Employees Series 2025 has been preliminarily calculated to SEK 0.96 per warrant. Final valuation of warrants of TO Employees Series 2025 will be made in connection with the participants' acquisition of the warrants and will be based on the market conditions prevailing at that time.

- Warrants of TO Employees Series 2025 held by the Company and not transferred to participants in accordance with the above guidelines shall be canceled by the Company following a decision by the board of directors of the Company and notified to the Swedish Companies Registration Office.

C. Other matters relating to the incentive programs under A. – B. above

Majority requirements and voting

Since persons falling under Chapter 16, Section 2, Subsection 1, Item 2 of the Swedish Companies Act (2005:551) (the "Companies Act") are included in the group of persons entitled to subscribe, valid resolutions require that they have been supported by shareholders with at least nine-tenths (9/10) of both the votes cast and the shares represented at the general meeting.

Motives for the incentive scheme and its preparation

The motives, as well as reasons for deviation from the shareholders' preferential rights, for the incentive program are that a personal and long-term ownership commitment among employees and consultants engaged in the Company can be expected to stimulate an increased interest in the business and the development of the results, increase motivation and the sense of belonging to the Company, and enable the Company to retain and attract the necessary competence. The board of directors believe that such an issue can be beneficial for the Company and its shareholders.

The proposals under A. KPO Employees Series 2025 and B. TO Employees Series 2025 have been prepared by the board of directors in consultation with external advisors. The final proposals have been presented by the board of directors.

Valuation

Entry into KPO Employees Series 2025 is free of charge. The value of an employee stock option will correspond to the difference between the quotient value per share and the share price of the share when exercised after the vesting period.

The proposal for the incentive program TO Employees Series 2025 signify that the subscriber participates on market terms. The price (premium) for the warrants shall be determined based on the established Black & Scholes valuation model, whereby the value is determined based on the share price, volatility, risk-free interest rate, time left to exercise, exercise price, etc. The calculation of the price (premium) will be performed by Option Partner.

Costs and dilution

According to the board of directors' assessment, the Company will not incur any costs for social security contributions in relation to the proposed incentive programs. The Company's costs are thus expected to consist of costs for implementation and practical management of the programs.

The incentive programs together comprise a maximum of 598,615 warrants and upon full exercise, a total of 598,615 new shares will be issued in the Company (subject to any recalculations in accordance with applicable terms and conditions). This corresponds to a dilution of the total number of shares in the Company as of the date of the notice by approximately 2.62 percent (based on the total number of shares after exercise).

Existing stock incentive programs

The Company's existing stock incentive programs are described on the Company's website www.beammwave.com/investors/aktier-och-optioner/, which together comprise 1,618,880 warrants and upon full exercise result in 1,618,880 new shares. This corresponds to a dilution of the total number of shares in the Company as of the notice date of approximately 4.88 percent (based on the total number of shares after exercise).

Majority requirement

For a resolution under item 13. to be valid, the resolution must be supported by shareholders representing at least two thirds (2/3) of both the votes cast and the shares represented at the meeting. For a resolution under item 14. to be valid, the resolution must be supported by shareholders holding at least nine tenths (9/10) of both the votes cast and the shares represented at the meeting.

Available documents

The annual report and the auditor's report will be available on the Company's website, www.beammwave.com and at the Company's office, for at least three weeks before the meeting. Full proposals for resolutions are included in the notice. The documents will be sent on request to shareholders who provide their postal address. The documents will also be available at the meeting.

Information at the meeting

The shareholders are informed of their right to request information in accordance with Chapter 7, Section 32 of the Swedish Companies Act regarding circumstances that may affect the assessment of an item on the agenda or the assessment of the Company's financial situation.

Processing of personal data

For information on how your personal data is processed in the context of the general meeting, see

https://www.euroclear.com/dam/ESw/Legal/Privacy-notice-bolagsstammor-engelska.pdf.

Lund in April 2025

BeammWave AB (publ)

THE BOARD OF DIRECTORS

For more information please contact:

Stefan Svedberg, CEO

+46 (0) 10 641 45 85

info@beammwave.com

About us

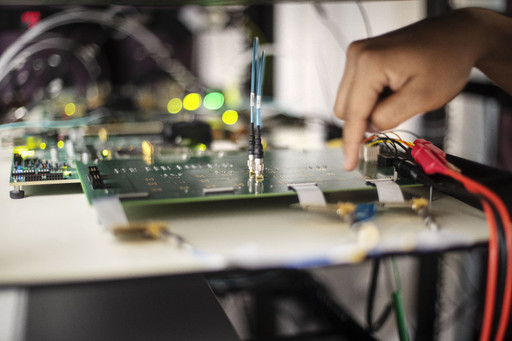

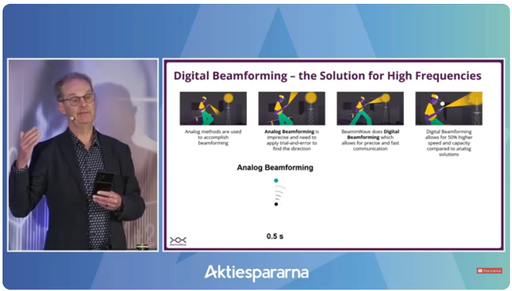

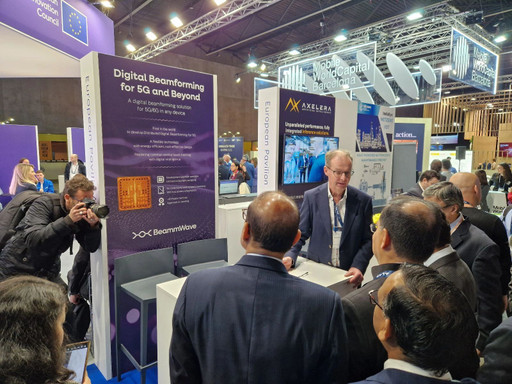

BeammWave AB are experts in communication solutions for frequencies over 24GHz. The company is building a solution intended for 5G and 6G, in the form of a radio chip with antenna and associated algorithms. The company's approach with digital beamforming is unique and patented, with the aim of delivering a solution with higher performance at a lower cost. The company's Class B shares (BEAMMW B) are listed on the Nasdaq First North Growth Market in Stockholm.

Certified Adviser is Redeye AB.